👋 Hello!

Welcome to the 1000+ new investors who joined for the 1st edition of Bullish or Bearish! Every week we read 100s of articles and research reports and distill all that info into an easy-to-read analysis.

The company under the microscope this week is Coinbase (COIN), the largest U.S.-based crypto exchange.

⬆️🐂 The Bulls Say:

Market Leader: Coinbase has established itself as the leading U.S. cryptocurrency exchange and has a strong reputation for security in an industry filled with risk for traders. They will be the main beneficiary if/when crypto continues to grow. BTC is up 83% YTD while COIN stock is up 113% over the same period.

Global Market: There is a global market for cryptocurrency. Regulatory approval from international regulators will allow Coinbase to expand its operations and increase its footprint globally.

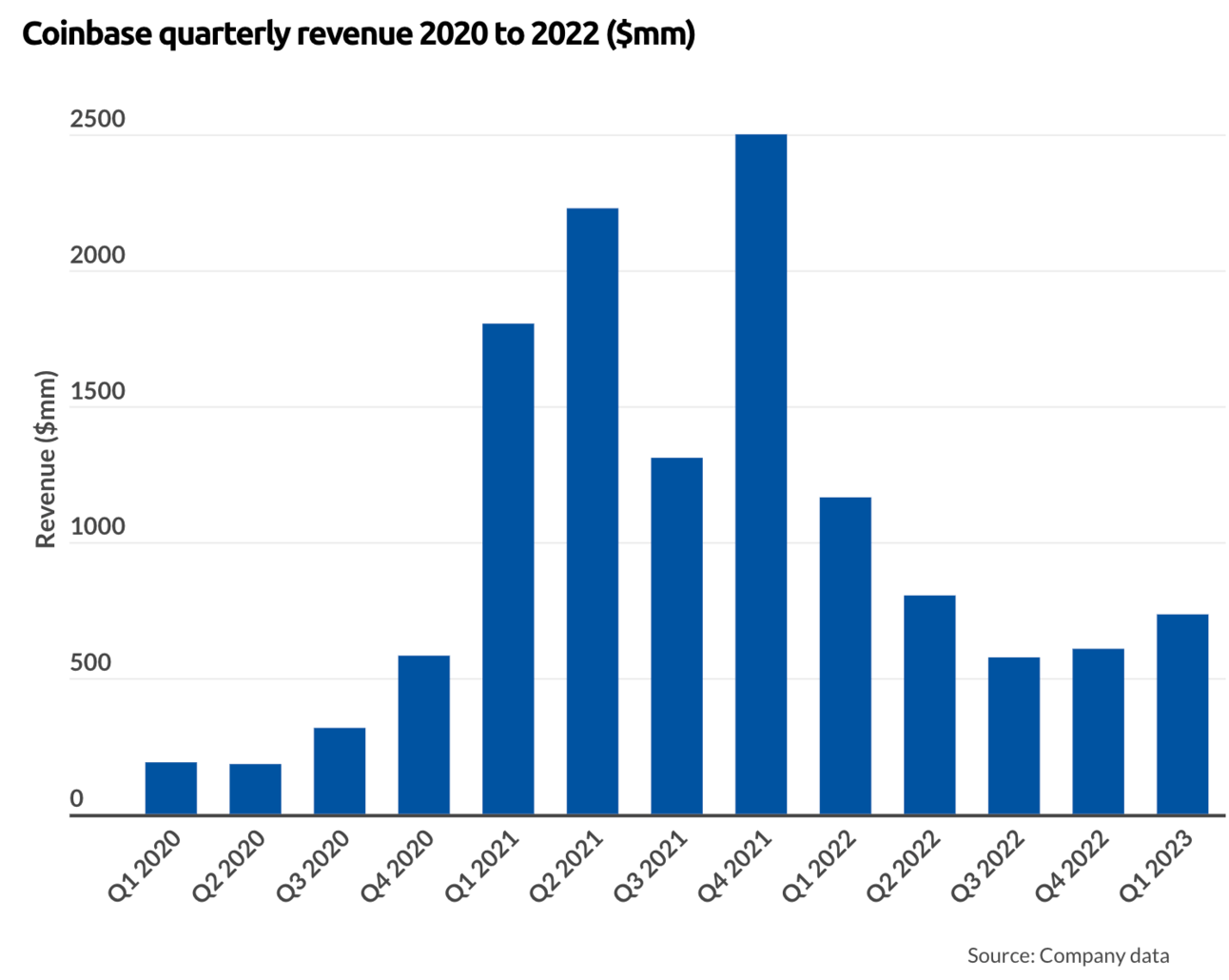

Revenue Growth: Despite a decrease, Coinbase's revenues were better than expected for the three months ended 31 March 2023. The estimated sales were 665.97M, but the actual announced value was 772.53M, recording an earnings surprise of 16%. This could be a positive sign for investors looking for companies with robust revenue growth.

⬇️🐻 The Bears Say:

Revenue Decline: Coinbase's one-year annual revenue growth rate has declined by approximately 59.25%, indicating a significant slowdown in the company's earnings. Coinbase lost $2.6B in 2022, a huge drop from its profit of $3B in 2021. This could be a potential concern for investors looking for growth.

Regulatory Risks/Legal Challenge: The U.S. Securities and Exchange Commission (SEC) has recently filed lawsuits against Coinbase, alleging that the company has breached its rules. This could potentially lead to fines and operational challenges for the company

Dependence on Transaction Fees: Most of Coinbase's revenue comes from transaction fees, and there are concerns that the crypto industry could follow the path of the stock trading industry where transaction fees have largely been eliminated. If this happens, Coinbase could lose market share unless it also eliminates transaction fees, which would hurt its revenue.

👨💻 Earnings Recap

On May 4, 2023 released Q1 earnings, announcing its 5th consecutive quarter of losses. COIN beat rev expectations but still hasn’t achieved profitability.

💩 Revenue: Coinbase reported a revenue of $772.53 million, which represents a decrease of 33.77% compared to the previous period.

💩 Gross Profit: The company's gross profit was $676.16 million, which is a decrease of 23.91% compared to the previous period.

⭐ Operating Income: Coinbase reported an operating income of $43.23 million, which is an increase of 112.59% compared to the previous period.

⭐ Net Income: The company reported a net income of -$78.89 million, an >80% improvement YoY.

⭐ Earnings Per Share (EPS): The actual EPS was -$0.3408, which was better than the estimated EPS of -$1.448676.

⭐ Total Assets: The total assets of the company were $139.30 billion, an increase of 566.67% compared to the previous period.

💩 Total Liabilities: The total liabilities of the company were $133.63 billion, an increase of 828.02% compared to the previous period.

💩 Total Equity: The total equity of the company was $5.67 billion, a decrease of 12.64% compared to the previous period.

🗞️ Recent news

Coinbase Will Be Surveillance Partner for Fidelity... - June 30, 2023

📊 It’s Chart Time!

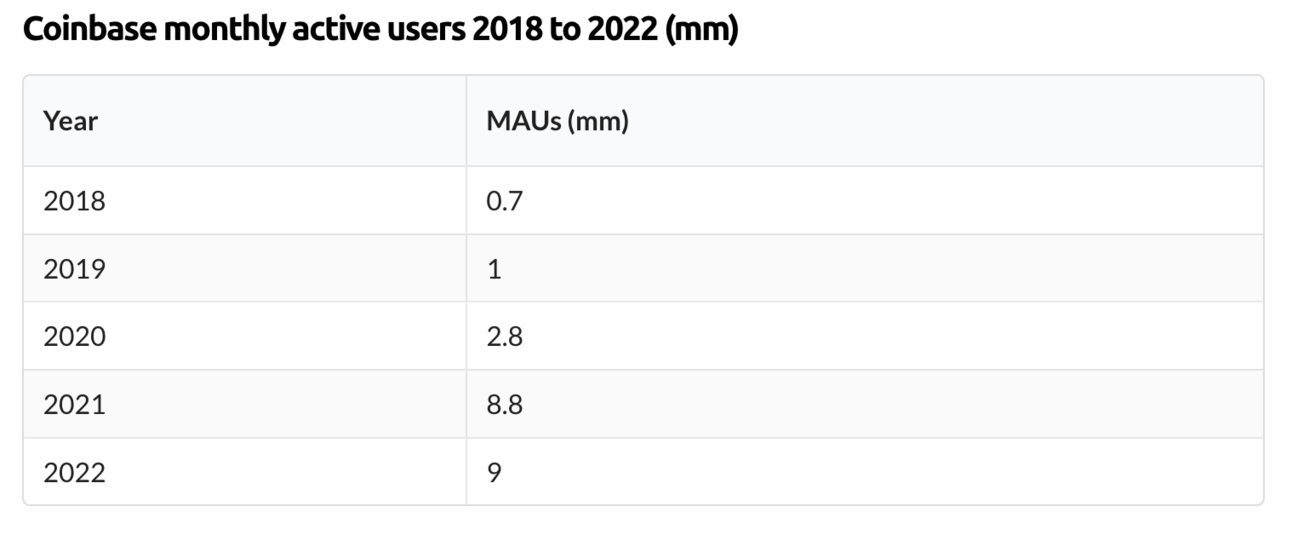

While their userbase grew from 56M in 2021 to 98 million users in 2022, MAU only slightly grew from 8.8M to 9.1M MAU during that period.

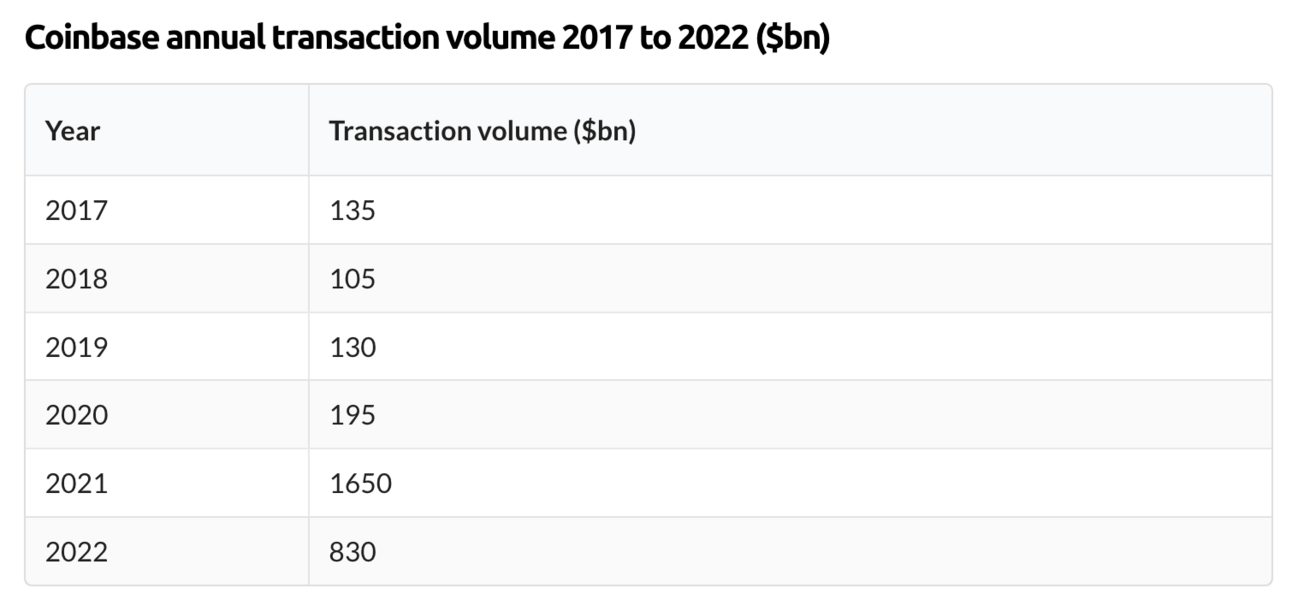

AUM significantly down from > $200bn in 2021

Up significantly from 2020 but down 50% from 2021.